Company in liquidation … What are your rights as a creditor?

Recent changes to insolvency regulations have granted creditors expanded rights to access company information, documents and reports.

1. Introduction

The Insolvency Practice Schedule (Corporations) contained in Schedule 2 of the Corporations Act 2001 (Cth) (Act), together with the Insolvency Practice Rule (Corporations) 2016 (IPR) govern the rights of creditors to request information, reports and documents from liquidators and administrators of a corporation under external administration, unless certain exceptions apply. These regulations will balance the flow of information between creditors, directors, members and insolvency practitioners.

2. External administrators and their obligations

An external administrator is defined in section 5-20 of the Act to include administrator of a company; administrator under a deed of company arrangement; liquidator; or a provisional liquidator. This definition excludes a receiver; receiver and manager, or controller in relation to property of the company. Should an administrator fall under this definition, the Act still imposes an obligation on the administrator to comply with the creditors request for information, report or document under section 70-45(2). However, there are circumstances where an administrator can refuse to comply with this obligation. An administrator is not required to provide information where it is irrelevant to the external administration of the company. Furthermore, an administrator is under both fiduciary and statutory duties owed to the company and not to the creditors or members (Hausmann v Smith (2006) 24 ACLC 688). Consequently, if a request results in his/her breach of duty, as described above, the administrator is exempt from complying with such a request. Lastly, the Corporations Act exempts administrators from complying with any ‘unreasonable’ request by creditors.

2.1 What is a reasonable request?

The IPR provides some guidance on what ‘unreasonableness’ could mean in section 70-15(2). Anything that falls outside this subsection is deemed to be a reasonable request (s 70-15(4)) and the administrator must comply with the request within 5 business days or at a later time as agreed with the person making the request (section 70-1(2)). Further extension of time is permitted if the administrator reasonably believes that the nature of the request requires an extension and complies with the formalities under section 70-1(3).

2.2 What is an unreasonable request?

If a request is unreasonable, the external administrator must notify the creditor and give reasons to the effect/s under (s70-5(2) of IPR). The seven circumstances where a request is considered unreasonable. In brief, these situations are where:

- the administrator believes that complying with a creditor’s request for information would result in prejudice to other creditors’ or third party’s interests. The administrator must act in good faith when exercising his or her discretion, however, this is necessarily a subjective decision;

- the requested information, report or document is protected under legal professional privilege;

- providing the information would result in a breach of confidence. In particular, the disclosure of a list of creditors and how much they are owed is governed by the Privacy Act. Such information may be critical to a creditor carrying out their right to monitor the conduct of an administrator;

- there is insufficient available property to comply with the request, unless the request is made in member’s voluntary winding up, or where the creditor agrees to bear the cost associated with obtaining information(s70-15(5));

- information has already been provided, unless all costs associated with reproduction of information is borne by the creditor (s 70-15(5);

- the information will be included in a statutory disclosure within the next 20 business days unless any costs associated with complying with such a request is borne by the creditor (s 70- 15(5)). This information includes any reports required by law to be provided to creditors such as initial information, statutory reports and such other reports as the liquidator decides; or

- the request is vexatious.

2.3 Vexatious requests

The word ‘vexatious’ is not defined in the Act or the IPR. However, it has been used and defined in other contexts. Some relevant definitions include requests that are without foundation or are brought for annoyance (Peruvian Guano Co v Bockwoldt (1883) 23 Ch D 225), if both requests seek the same relief (Sunland Waterfront (BVI) Ltd v Prudentia Investments Pty Ltd [2013] VSCA 237), or when two requests are brought where one would do.

Section 70-15(3) further narrows the definition of vexatious by deeming similar requests made within 20 business days to be vexatious. According to the Explanatory Statement, this timeframe does not mean that a request may not be vexatious if made outside that timeframe. The example given is where a creditor on multiple occasions asks for the same information 21 business days after receiving the answer to their last request.

3. Commencement date

These rules are effective from 1st September 2017 and apply to all new and ongoing external administrations (s1591 of Corporations Act) including all external administrations that started prior to the commencement date and are ongoing (s1578 of Corporations Act).

4. Conclusion

The new amendments to IPR aim to improve creditors’ ability to engage in the administration process. This should ultimately allow creditors to make informed decisions and to monitor the external administration process. This higher level of transparency is also likely to reduce the number of disputes that are fundamentally commercial in nature. However, the limitations imposed on complying with such obligations will ensure that the company’s interests and needs remain the priority and are properly looked after without burdening administrators with additional responsibilities.

5. Further Information

If you are a creditor and believe that you are being denied your rightful request to company information, we would be pleased to meet with you to discuss matters in more detail. Auxilium Partners has extensive experience in advising on disputes related to partnerships and small to medium sized business in Western Australia.

This article is intended as information only. It is not intended to be or to constitute legal advice and must not be relied on as such. While every attempt is made to ensure the content of this article current, we do not guarantee its currency. You should seek appropriate legal advice specific to your circumstances before acting or relying on any of the content.

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

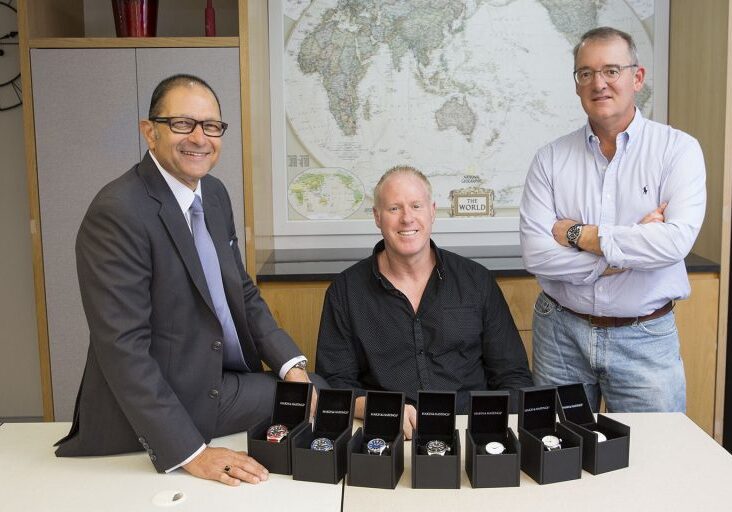

About Auxilium Partners

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.