News

All

- All

- Business Restructuring

- Forensic Accounting

- Mining Advisory

- Financial Consulting

- News

- Insolvency

- Whitepapers

- For Directors

- For Accountants & Lawyers

- For Creditors

- For Employees

KEEP THE HONEY FLOWING – HOW & WHEN!

Have you heard about the smart directors who asked Bob Jacobs and Andrew Smith to help their bees? VOTED MOST...

Five big tests for small businesses in 2024

Cash flow, new IR rules, and the threat of cybercrime are making life for small enterprises even more precarious. For...

Auxilium Mining Advisory Update: Critical Metals – Nickel and Lithium Focus – Timing is Everything in Mining

The tide can turn quickly and relentlessly in the mining cycle. Go back 12-18 months ago and even mid 2023...

Deduction denied!

Government to abolish tax deduction for GIC and SIC, along with increased interest costs… The Australian Government has recently announced...

How WA mining can create a bright road ahead for future generations FY23/24 critical minerals

As a key natural resources contributor in a world transitioning to net zero carbon position, Western Australia’s mining industry is...

Operate, Expand, Diversify or Divest

The Mining sector is facing headwinds from inflationary pressures and global market uncertainty despite robust demand outlook for key commodities...

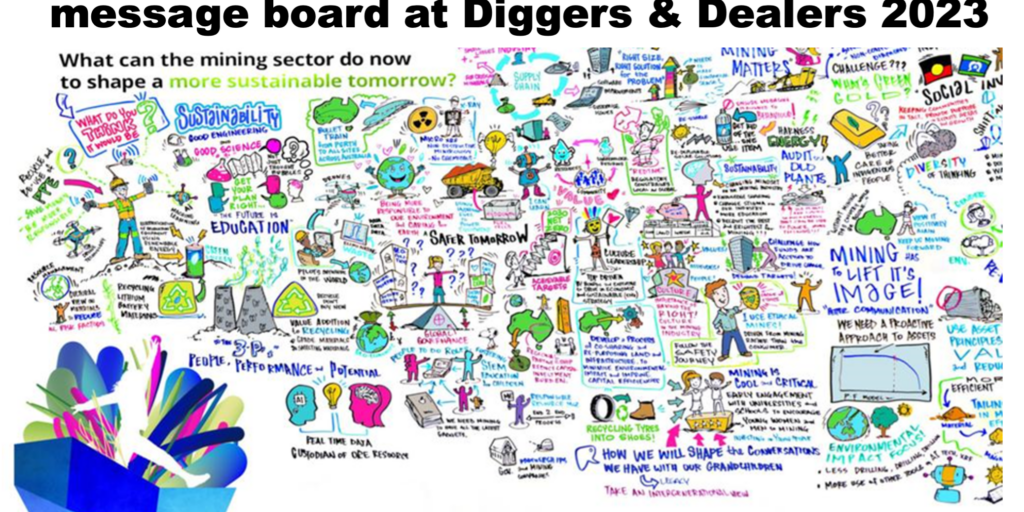

Diggers & Dealers 2023 = ESG = Sustainability

One of the most important issues in mining today is the growing emphasis on sustainable and responsible mining practices. We...

Wagons, Saddlebags, Drowning – Navigating Business Challenges

Dire predictions of insolvencies hit the headlines during the COVID-19 pandemic when our business landscape faced unprecedented challenges. The term...

Financial Stress and Insolvency Changes

Changes to insolvency regulations granted creditors expanded rights to access company information, documents and reports. 1. Introduction The Australian Government...

Company in liquidation … What are your rights as a creditor?

Recent changes to insolvency regulations have granted creditors expanded rights to access company information, documents and reports. 1. Introduction The...

Insolvent Trading Provisions For Company Directors

Safe Harbour” for Company Directors: New legislation offers protection from insolvent trading when guiding business out of trouble. Recent amendments...

Director Identification Number (DIN)

New legislation has been introduced into the Parliament, which obliges all directors to obtain a Director Identification Number (DIN) under...

More Protection For Whistle-blowers

The Whistle-blower protection provisions contained in Part 9.4AAA of the Corporations Act 2001(Cth) (Act) have been in operation for a...

What Is A Certified Fraud Examiner (CFE)?

Certified Fraud Examiners are specialised professionals worldwide who have demonstrated high level ability to achieve across the same rigorous criteria....

Construction Industry Distressed Asset Workout

“Distress in construction and some practical tips that construction businesses might take insituations when they are staring down a financial...

Collaborate and Communicate with SBR specialist – Avoid Liquidation

Auxilium Partners have done it. Successful Small Business Restructuring (SBR) of a Perth hospitality business (liabilities of less than $1Million)...

Tax time cashflow: time to talk turkey with your clients

Attention trusted advisors working with small business owners: what to ask your clients at tax time or any time Are...

How to detect and guard against fraud. Is Bitcoin a Ponzi scheme?

Should Bitcoin, Ponzi and Maddoff be considered together? Diana Henriques was the original reporter who interviewed Bernie Madoff in gaol...

Fertile Ground for Fraud post COVID

Major economic disruptions such as COVID low interest loans and supply chain disruptions increase the need and opportunity for financial...

The ATO no longer an overdraft bank account

Businesses with over $100,000 in tax debts started receiving letters in September 2021 from the ATO warning them that their tax debt information would be reported to credit reporting bureaus (CRB) if the ATO...

Prevent bad debts with PPSR and Retention of Title (RoT)

Note: The following information is general in nature. Please consult your lawyers for advice appropriate to your business. When selling...

Don’t get caught out by this business email scam

Business Email Compromise (BEC) scams are on the rise in Australia and businesses need to be especially alert to the dangers. BEC...

How directors can find themselves personally liable for company debt

One of the advantages of operating a business through a company is the separation of business and personal assets. However, since...

ATO payment plans may not be the best option in 2021

Having an arrangement with the Australian Tax Department (ATO) to pay off tax debt by instalments can seem like the...

Warning signs that your company is insolvent

Insolvency is defined as the point when a company can’t pay its debts when they are due. If your company is showing signs of financial problems, it’s your...

5 steps to get your outstanding invoices paid ASAP

Do you have a client who regularly pays invoices late or is refusing to pay at all? It is a...

Small Business Restructuring (SBR) option for directors

In response to COVID, Australia has introduced more options for small business to simplify the process of resolving financial difficulties....

My company might be insolvent. What must I do as Director?

If your company is in financial distress, it’s important to determine if it is just a temporary cash flow issue...

‘Where has all the money gone?’ You may need a forensic accountant

When a business finds itself struggling, a forensic accountant uses their expert auditing and investigation skills to examine financial complexities...

20 day Voluntary Administration: business rescue

Auxilium COVID Restructuring (ACR) For ANYONE who is a business owner experiencing financial challenges.For accountants and lawyers - we all...

RCR Tomlinson. Who will suffer most?

The downfall of RCR Tomlinson affects hundreds of contractors who are currently engaged to work on projects across Australia. Appointed...

Pilbara Properties | Greedy, Misguided or Hopeful?

Everyone has a story about the recent mining boom and bust in WA. Bob Jacobs was approached by several people...

Pizza Hut – High Court Decision “Sets The Stage”

A landmark decision was made on 18 May 2018 by the High Court of Australia where concession of "good faith"...

PIZZA HUT – What is reasonable for franchisees?

1. What is “reasonable” behaviour for franchise businesses in Australia? The duty of franchisors to act reasonably should be independently...

GCG – Construction of the Policy

Liquidator Bob Jacobs wins Crime Protection claim on behalf of Global Constructions Australia in Federal Court Insurance List for short...

PIZZA HUT. You can’t win them all

In Sydney, three Federal Court Justices, John Gilmour, John Nicholas and Mark Moshinsky, ruled against liquidator Bob Jacobs acting on...

The Negotiator, Banker, Marketer and Watchmaker

Bob Jacobs (left), Jason Reaby and Matt Sears with some of Haig and Hastings' stock of watches. Photo courtesy BNWA...