ATO payment plans may not be the best option in 2021

Having an arrangement with the Australian Tax Department (ATO) to pay off tax debt by instalments can seem like the perfect answer BUT there are consequences. Yes, it does take the pressure off short term cash flow shortages. However, problems arise when instalment plans are entered into without regard to the ongoing viability of your business. COVID-19 has created economic uncertainty and loss. Please take specialist advice before deciding if an ATO instalment plan is the best solution to tax debt.

4 reasons why an ATO payment plan needs careful consideration these days:

1. If the company is liquidated in future, directors may be liable for tax debts

After the instalment arrangement is in progress or completed, the liquidator may seek to recover instalments paid to the ATO as unfair preferences. Subsequently, the ATO may seek coverage of the lost instalments from the directors which translates to personal liability.

2. Defaults on tax debt instalment plans makes debts repayable immediately

Companies must agree to keep their tax lodgements up to date when the instalment process starts and failure to do so will void the arrangement. The entire debt will then become repayable immediately and without warning. The ATO can then begin actions under law such as director penalty notices and taxation garnishes.

3. Tax debts discourage banks from further lending to the business

If a business runs into trouble and requires funding to improve cash flow, most major banks will not grant loans to companies with a tax debt such as an instalment payment plan. The business owner may then have no other choice than to go to a non-bank lender with inflated interest rates.

4. Business loans have lower interest rates than ATO instalment plans

In the current low-interest-rate environment, the ATO’s interest rates (once considered reasonable) are up to two times higher than cost of a business loan (if such a loan is accessible as an option to resolve the tax debt).

In summary, before a director enters an ATO agreement, they must ask themselves if their company is dealing with a short-term cash flow issue (if so, please make the tax instalment plan for as short a term as possible) or heading towards insolvency. If you consult a specialist solvency accountant they can help business owners and their tax accountants or lawyers decide on the health of the company and the best way to restructure or otherwise deal with tax debt.

Contact Auxilium Partners today to find out how we can help. the first consult with us always free.

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

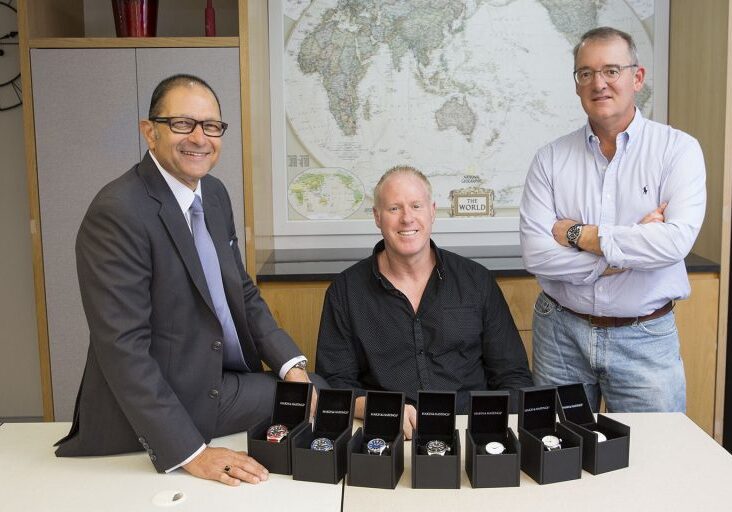

About Auxilium Partners

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.