Posts by Auxilium Partners

Five big tests for small businesses in 2024

Cash flow, new IR rules, and the threat of cybercrime are making life for small enterprises even more precarious. For small businesses there is little holiday respite from the operating challenges that are set to flow into the new year. Rising business costs defined 2023, with trends indicating 2024 will be even tougher. According to…

Read MoreAuxilium Mining Advisory Update: Critical Metals – Nickel and Lithium Focus – Timing is Everything in Mining

The tide can turn quickly and relentlessly in the mining cycle. Go back 12-18 months ago and even mid 2023 and we had experienced substantially stronger metal prices for nickel and lithium than at present. This also entailed strong investment in these critical metals and a rush of new IPO’s hitting the market. As we…

Read MoreDeduction denied!

Government to abolish tax deduction for GIC and SIC, along with increased interest costs… The Australian Government has recently announced the scrapping of ATO General Interest Charges (GIC) and Shortfall Interest Charges (SIC) as allowable tax deductions for both companies and individuals effective from 1 July 2025, along with significantly increased interest costs. This has…

Read MoreHow WA mining can create a bright road ahead for future generations FY23/24 critical minerals

As a key natural resources contributor in a world transitioning to net zero carbon position, Western Australia’s mining industry is in an enviable position to build on its reputation as a global mining hub. The Australian mining sector as a whole contributed close to 14% of Australia’s GDP in FY23 with a record $460 billion…

Read MoreCollaborate and Communicate with SBR specialist – Avoid Liquidation

Auxilium Partners have done it. Successful Small Business Restructuring (SBR) of a Perth hospitality business (liabilities of less than $1Million) READ MORE

Read MoreTax time cashflow: time to talk turkey with your clients

Free online tools for trusted advisors to ask their small business owners the hard questions.

1. Are they trading profitably?

2. Have they put enough aside to meet their regular financial commitments?

3. Does their business have enough to spend on themselves and pay others?

4. Is their business improving its financial position

How to detect and guard against fraud. Is Bitcoin a Ponzi scheme?

Should Bitcoin, Ponzi and Maddoff be considered together? Diana Henriques was the original reporter who interviewed Bernie Madoff in gaol (jail). She reminds us “The #1 lesson Madoff’s fraud teaches anti-fraud professionals is that no deterrence program, however elaborate, will work if it can be switched off when we are approached by people we trust.”…

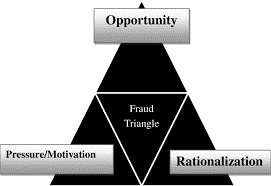

Read MoreFertile Ground for Fraud post COVID

Major economic disruptions such as COVID low interest loans and supply chain disruptions increase the need and opportunity for financial fraud. How do certified fraud examiners detect fraudsters who “fudge the figures”? The gold standard for investigating financial fraud begins with ABC from the Donald Cressey Fraud Triangle. A. Financial need – motivation – pressure.…

Read MoreThe ATO no longer an overdraft bank account

Businesses with over $100,000 in tax debts started receiving letters in September 2021 from the ATO warning them that their tax debt information would be reported to credit reporting bureaus (CRB) if the ATO was not engaged within 28 days. If your client received this letter and interactions were not initiated to put a payment plan put in place, the ATO may very soon report your client’s outstanding tax debt with CRBs such as Credit Watch and…

Read MorePrevent bad debts with PPSR and Retention of Title (RoT)

When selling goods on credit, the Retention of Title (RoT) clause ensures that ownership (or title) of the goods supplied are not transferred to the customer until the customer has made full payment, even if they have taken possession of the goods

Read More