Fertile Ground for Fraud post COVID

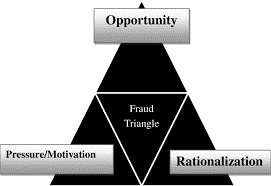

Major economic disruptions such as COVID low interest loans and supply chain disruptions increase the need and opportunity for financial fraud. How do certified fraud examiners detect fraudsters who “fudge the figures”? The gold standard for investigating financial fraud begins with ABC from the Donald Cressey Fraud Triangle.

A. Financial need – motivation – pressure. Arising from the COVID-19 epidemic is a interesting example of financial need: the debt dilemma. Business borrowers are being forced to refinance debt because the low interest COVID-19 support loans are now maturing. Affected business owners (some of whom offered personal guarantees) are under huge pressure to “improve” the look of financial statements as they seek debt refinancing. Another example, related to current worldwide stock inventory problems and supply chain delays, relates to using alternate accounting methods to “improve” the look of a financial statement when sales do not occur as forecast due to lack of stock. Fraud examiners seek evidence for and against materiality because they are aware that not all so-called financial statement fraud is illegal.

Motivations for committing fraud can be grouped into six categories according to one Australian report:

1. Greed

2. Gambling

3. Financial strain (personal or business)

4. Continuation/viability of business

5. Influence of others

6. Other (dissatisfaction with employer and/or salary underpayment)

In the same Australian report of fraud convictions, women had a wide variety of motivations such as “not being able to refuse their families anything; wishing to appear a ‘perfect wife and mother’; needing to contribute more to the household finances (especially where their partner was the major earner); supporting children after break-up of a relationship; wishing to buy gifts for partners to demonstrate affection; ensuring the continuation of a business, whether this was their own, a family business or the organisation for which they worked.”

The most common justifications/motivations for men were intention to conduct legitimate business and intention to repay. The offender profile was as expected: aged in mid-40s; educated to secondary level (some had professional qualifications); company directors or involved in accounting duties; relatively stable employment; no prior criminal record; acting alone in the commission of the offence; motivated by greed or gambling.

B. Opportunity. In 2021, doctors and allied health workers in the USA were arrested for alleged telehealth fraud of $1.1billion (FRAUD, January 2022). Medical billing fraud is not new. However, since telemedicine is here to stay in the post-pandemic world, it is vital to implement more robust checks and balances to validate the reality of patient interaction before providers are paid for services. Not to be forgotten is the potential for labs, pharmacies and other health providers (related to NDIS in Australia) to be tempted to inflate services or accept illegal kickbacks for submitting fraudulent claims to health authorities.

C. Rationalisation. The Australian Institute of Criminology reminds us that motivation and rationalisation (or neutralisation) to commit fraud should not be confused. One distinction is that ‘motivation drives the act, whereas rationalisation/neutralisation seeks to nullify internal moral objectives’ (Duffield & Grabosky). Fraudsters always believe their need is more pressing than the possibility of getting caught. We have all heard the common phrases: “nobody will miss a bit of money” or “I will pay the money back soon” but there is an emerging rationalisation “the company doesn’t pay me enough” or “I am smart so I can ‘fudge the figures’ and no one will know.”

Certified Fraud Examiners (CFE) are trained to investigate people as well as numbers. Limiting financial fraud is the subject of another article. However, by now you should be asking yourself four questions:

- Why would people within this business commit fraud? NEED & RATIONALISATION

- How would they commit fraud? OPPORTUNITY

- What key people could need to embezzle a material amount from the business? OPPORTUNITY & NEED

- How would each person be able to do it? OPPORTUNITY

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

About Auxilium Partners

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.