The ATO no longer an overdraft bank account

Businesses with over $100,000 in tax debts started receiving letters in September 2021 from the ATO warning them that their tax debt information would be reported to credit reporting bureaus (CRB) if the ATO was not engaged within 28 days.

If your client received this letter and interactions were not initiated to put a payment plan put in place, the ATO may very soon report your client’s outstanding tax debt with CRBs such as Credit Watch and Dunn & Bradstreet.

The ATO’s latest tax recovery action aims to prevent businesses from using the government as an overdraft bank account because this gives them an unfair advantage against competitors who use commercial financial resources.

What this means for businesses reported:

- New finance applications could be rejected

For the next 5 years, when the business applies for finance or a credit account, a CRB will reveal all debts to the creditor. This includes tax debts (income tax, GST, PAYG withholding, superannuation guarantee, penalties and interest) and maximum credit cards limits. Large debts will impact adversely on the risk level or rating assigned to the applicant.

- Existing creditors could demand immediate repayment

If a current loan contract contains a ‘failure to disclose’ clause, the financier can trigger this clause and call for immediate repayment of the loan in full. Such actions will likely threaten business viability, exposing company directors to personal liability for company debts and consequences such as insolvent trading and/or liquidation.

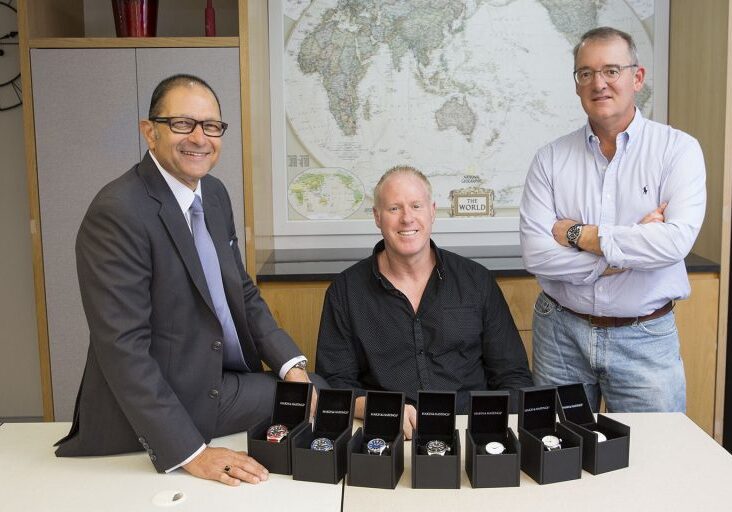

Auxilium Partners is registered with ASIC with more than 30 years of experience engaging with the ATO on behalf of clients. We work with your company accountant or bookkeeper to prove the viability of your business and negotiate a payment plan when appropriate.

Auxilium’s comprehensive 4-step process is collaborative, cost-effective and structured to deliver the best possible outcome. Book a free consultation to find out more about how we can help.

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

About Auxilium Partners

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

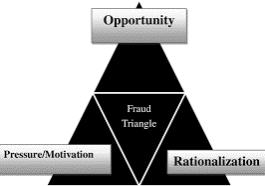

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.