Director Identification Number (DIN)

New legislation has been introduced into the Parliament, which obliges all directors to obtain a Director Identification Number (DIN) under the Corporations Act 2001 (Cth). This regime is intended to be administered by the Australian Business Registrar with the ATO and can make investigations easier for external administrators, and other regulatory government bodies.

1. Introduction

Under the proposed provisions, all current directors and people who intend to become directors must, within 12 months, establish their identity to the Registrar who will allocate them with a Director Identification Number (DIN). This identification number is unique for each individual (similar to a passport number or driver’s licence number). The same DIN must be used every time an individual is registered as a director of a company. This will subsequently allow for traceability of director’s relationships across all companies and enable tracking of directors of failed companies and their involvement in what may be repeated unlawful activity such as phoenix activity.

The new provisions apply to Australian or registered foreign companies or bodies, and Aboriginal and Torres Strait Islander Corporations.

2. Establishing Identity

It is not yet clear how and to what level of certainty the directors are required to establish their identity. Professor Helen Anderson has suggested in her submission to the Treasury that it should be the same level of identification that is currently needed for passports or for verification of identity for land transfer. This is because the mechanisms used in the aforementioned context are already in place, transferable and the costs associated with the use of such platforms are known.

ARITA has also suggested linking each DIN to tax file number of the relevant person. This could result in a more efficient process as the Registrar can be satisfied as to an individual’s identity.

3. Benefits to Insolvency Practitioners

One particular benefit of DINs for external administrators is that the ability to track directors and their history more effectively will reduce cost and time, which will in turn improve efficiency of the insolvency process. The new provisions also prohibit a person from applying for or holding multiple DINs unless allowed under subsequent legislation. This will preserve the integrity of the new scheme. In addition, there are both civil and criminal implications for individuals not applying for a DIN or making misrepresentation of a DIN to a body that is likely to rely on it for regulatory compliance or identification purposes.

4. Limitations

The current legislation simply requires an eligible officer to apply for a DIN. An eligible officer is defined as a director of a registered body who is appointed to the position of a director or an alternate director, or any officer of a kind prescribed by regulation.

Therefore, the proposed law does not yet apply to a shadow and de-facto director or company secretary who may be the driving mind of a corporation.

In addition, the time limits for making a DIN application have been heavily criticised for being too lenient. ARITA, in their submissions to the Treasury, outlined how these generous time limits could be used by directors or their financial advisors to allow for phoenix activities and have suggested a much shorter period for compliance with the new provisions.

5. Our Comments

To obtain a more wholistic history of a director, we consider it worthwhile to link each DIN to AFSA’s Personal Insolvency Index. This would be a very useful tool for external administrators to obtain a more complete search outcome, reduce costs associated with conducting multiple searches and reduce time dedicated to the investigation phase of each external administration. Such links could allow financiers and prospective business associates to view relevant DINs to assist them to make sound commercial decisions.

6. Conclusions

The DIN will certainly simplify investigations and allow for a more efficient liquidation process by reducing costs and time associated with researching the history of directors. However, as it has already been mentioned, there is room for improvement. We will continue to monitor this space and bring you updates on further changes to the Bill concerning the Directors Identification Number.

7. Further Information

If you are concerned about how this reform may impact you, we would be pleased to meet with you. Auxilium Partners has extensive experience in advising on directors’ disputes for small to medium sized business in Western Australia. For more information, please

This article is intended as information only. It is not intended to be or to constitute legal advice and must not be relied on as such. While every attempt is made to ensure the content of this article current, we do not guarantee its currency. You should seek appropriate legal advice specific to your circumstances before acting or relying on any of the content.

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

About Auxilium Partners

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

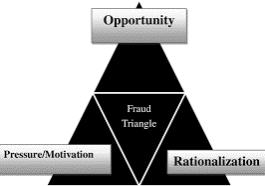

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.