Insolvent Trading Provisions For Company Directors

Safe Harbour” for Company Directors: New legislation offers protection from insolvent trading when guiding business out of trouble.

Recent amendments to the CorporationsAct 2001 (Cth)will allow directors to have a go at trying to save their companies during difficult times without worrying about personal liability under insolvent trading provisions.

1. Introduction

For many years, it has been the case that if a financially struggling company incurs a debt, that debt could be recovered from its directors in Section 588G of the Corporations Act 2001 (Cth). This Act imposes a duty on directors to prevent trading while insolvent or becoming insolvent by incurring a debt when insolvency was known or suspected by directors.

Section 588G as it was, could essentially result in contractual agreements that are fundamental to the operation of a business (such a supply contract) becoming a personal liability of that director. As a result, directors have historically, been reluctant to continue business operations during financial difficulties and have terminated the company as a “safer” option leading to the premature “death” of many entrepreneurial businesses.

To combat this issue, Parliament introduced new provisions s588GA in effort to accelerate growth in the Australian Economy.

2. The Reform

This new provision is “Section 588GA Safe Harbour – taking course of action reasonably likely to lead to a better outcome for the company”. Subsection (1) of s588GA precludes application of the s588G (2) if the company director suspects insolvency but allows him/her to start taking one or more courses of action that are reasonably likely to lead to a better outcome for the company and any debt incurred is directly or indirectly in connection with such course/s of action.

A similar provision has also been added after s588W to provide a safe harbour for holding companies. To benefit from either of the safe harbour provisions, certain elements must be satisfied.

2.1 Reasonably Likely

This element requires the course of action taken by directors to be reasonably likely to result in a better outcome for the company. Reasonably likely does not require a 50% chance of better outcome. It requires a chance of achieving a better outcome that is not fanciful or remote, but

is fair, sufficient or worth noting.1 This requires a minimum level of care and diligence to be exercised by directors in making commercial decisions because any unreasonable debt would activate the operation of s 588G.

2.2 Better Outcome

The better outcome element is defined in section 588GA(7) to mean an outcome that

is better for the company than the immediate appointment of an administrator or liquidator for the company.

To assist with this criteria, s 588GA(2) sets out guidelines to determine whether a course of action is reasonably likely to lead to a better outcome. In assessing the merits of a course of action, it shall be apparent that directors:2

- have properly informed themselves of the company’s financial position;

- are taking appropriate steps to prevent any misconduct by officers and employees;

- are ensuring that appropriate steps are taken to keep financial record;are obtaining advice from an appropriate qualified entity;

- are developing or implementing a plan for restructuring the company to improve financial position.

It is worth noting that the above factors are not an exhaustive list. However, it is a useful guide as to what indications the court would look at in order to determine whether an action was likely to result in a better outcome.

The burden of proving whether a course of conduct has resulted in a better outcome for the company will lie with the Director/s relying on the safe harbour provision.3

2.3 Direct or indirect debts

The Legislation makes it clear that not all debts will be safeguarded from operation of s 588G. Only debts incurred directly or indirectly in connection with developing or taking the course of action are deemed to be reasonable for the purposes of the safe harbour provisions including:4

- Trade debts incurred in usual course of business;

- Debts taken on for the specific purpose of affecting a restructure as part of that course;

- Debts associated with the sale of assets which would help the business’s overall financial position.

Thus, it is abundantly clear that s 588GA is not a blanket provision to provide protection for all transactions. Directors must be fully aware of the restructuring plans of the company and make decisions that will advance the survival of the company to avoid personal liability.

3. Exceptions

Not all conduct of directors will attract the protection offered under s 588GA. The Safe Harbour provisions will not operate in relation to a person or a debt if at the time the debt was incurred, the company failed to do one or more of the following:

- Pay entitlements of its employees when they fall due;

- Submit return, notices, statements, applications or other documents as required by the ATO; and

that failure to comply with above or failures occurred 12 months prior to the debt in question being incurred is considered to be less than substantial compliance.

Furthermore, the Safe Harbour provision does not extend beyond civil liability set out in section 588G(2). Therefore, directors can be criminally liable.

Importantly, companies fall outside the scope of the safe harbour provisions if directors:5

- fail to comply with its continuous disclosure obligation;

- are not developing or taking a course of action that would have reasonably lead to a better outcome when debts were incurred;

- have taken a passive approach to the business’s position or allowed a company to continue trading as usual during severe financial difficulty, or whose recovery plans are fanciful;fail to implement a course of action, or to appoint an administrator or liquidator within a reasonable time of identifying severe financial difficulty.

- lack honesty and diligence and have failed to pay obligations to employee or tax office; or,

- fail to provide an administrator or liquidator with certain required information.

4. Director Obligations

4.1 Act within reasonable time

The Safe Harbour provision requires directors to act within a reasonable time to decide on a course of action, during which they can enjoy the protection of the safe harbour. What is reasonable depends on the size of the company and is determined on a case by case basis. However, what is clear is that this period is not an excuse to tarry.6 Directors should move promptly and decisively toward implementing a suitable course of action.

4.2 Interest of Creditors

Safe Harbour provisions are not intended to adversely impact on the interests of creditors and will not prevent appointment of an administrator, liquidator or receiver by a third party.

Additionally, directors must fully disclose the affairs of the business to administrators or liquidators. Failure to provide appropriate books and records to the administrator or liquidator will deem that information inadmissible at Court, if the directors aim to use them to rely on the safe harbour provision.

This ensures that books and information not available at the time a liquidator or administrator is appointed are not later prepared in a way to make it retrospectively appear that a director would have fallen within the Safe Harbour provisions.

Safe Harbour will not protect a Director from actions brought for any other breach of the law, including breach of Director Duties. Ongoing diligence is expected from directors. For example, companies whose immediate solvency is in question should not continue trading without compelling reasons. Companies whose long-term solvency is doubtful should not trade without well-considered plan in place.7

5. Period of Safe Habour

Safe Harbour provisions apply from the time directors suspect insolvency and commence taking actions that are likely to result in a better outcome (as discussed above); and cease to operate when the company stops taking the course of action, or where the course of action stops being reasonably likely to lead to a better outcome and the company goes into administration or liquidation.

6. Conclusion

The Safe Harbour provisions in the Corporations Act began operation on 19 September 2017 to encourage entrepreneurship and innovation and grow the Australian economy. These provisions will allow companies to continue to trade for as long as possible to assist start-ups to find their place in the market. These changes have come at a perfect time to allow Australian businesses to ride the current wave of digital disruption more comfortably, knowing that as long as Directors act honestly and in good faith, the Corporations Act will operate to safeguard them from personal liability.

7. Further Information

If you are interested to know about how this reform can assist you or your business, we would be pleased to meet to explore your options. Auxilium Partners has extensive experience in advising on business re-structures and partnership disputes for small to medium sized business in Western Australia.

1 Explanatory Memorandum. Treasury Law Amendment

(2017 Enterprise Incentive No.2) Bill 2017, 14.

2 Corporations Act 2001 (Cth) s 588GA(2).

3 Corporations Act 2001 (Cth) s 588GA(3).

4 Above n 1, 13.

5 Above n 1, 11.

6 Ibid 12.

7 Ibid.

This article is intended as information only. It is not intended to be or to constitute legal advice and must not be relied on as such. While every attempt is made to ensure the content of this article current, we do not guarantee its currency. You should seek appropriate legal advice specific to your circumstances before acting or relying on any of the content.

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

About Auxilium Partners

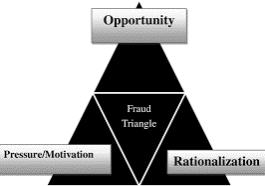

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.