Small Business Restructuring (SBR) option for directors

In response to COVID, Australia has introduced more options for small business to simplify the process of resolving financial difficulties. This will allow more businesses to avoid insolvency, meaning a better outcome for businesses, creditors, employees and the overall economy.

1. Small business restructuring (SBR)

The small business restructuring process now allows small and medium size businesses to compromise (negotiate payment of) their creditor debts and restructure themselves – allowing them to remain in control of their business during the restructuring process. A restructuring practitioner (RP) must be appointed to oversee the process and help develop the debt restructuring plan and restructuring proposal statement. The RP must be a Registered Liquidator.

Small business restructuring is accessible to companies that:

- Are insolvent or likely to become insolvent

- Have less than $1M in liabilities

- Are up to date with all ATO lodgements and have paid all employee entitlements

- Have not previously conducted a small business restructuring or simplified liquidation in the last 7 years

- Have not had a Director in the last 12 months who has used simplified liquidation or small business restructuring in the last 7 years (some exceptions apply)

- Are not already subject to insolvency administration

The following has been simplified for SBR:

- Directors form a restructuring plan with assistance from RP

- No requirement for creditors’ meetings

- RP certifies the plan is reasonable

- Directors remain in charge of company affairs

- RP is not liable for debts incurred during this restructuring period

- Restructuring plan presented to creditors within 20 business days of RP appointment

- Trade creditors may withdraw credit facilities and move to COD

- Company deals with goods subject to PPSR in ordinary course of business

2. Simplified liquidation (SL)

This is essentially a simplified version of the Creditors Voluntary Liquidation (CVL) which was used as a one-size-fits all liquidation process. The simplified liquidation process is intended to be more cost effective by reducing the current CVL requirements, thus increasing returns to creditors.

This process can only be administered by Registered Liquidator (RL). A Registered Liquidator can transfer to simplified liquidation if less than 20 days have passed since appointment but NOT if over 25% of creditors by value request a full CVL process be used.

Simplified liquidation is accessible to companies that:

- Are insolvent or likely to be so

- Have liabilities of less than $1M

- Have no company director who has previously used simplified liquidation process or small business restructuring

The following has been simplified for small business:

- No investigations for s533 report to ASIC

- No meetings of creditors

- No committees of inspection

- Restricted preference payment recovery

- ASIC or creditors cannot appoint reviewing liquidator

Understanding what your rights are as a Director is vital and you should seek advice from a registered liquidator who is experienced in the complexities of insolvency law (even when liquidation is not required).

The first meeting with Auxilium Partners is always free. Contact us today to find out how we can help.

Like what you read?

Share this article across your network.

Are you in need of help and advice? Chat with our Special Situation Accountants.

Solutions

Let Auxilium take some of the load.

About Auxilium Partners

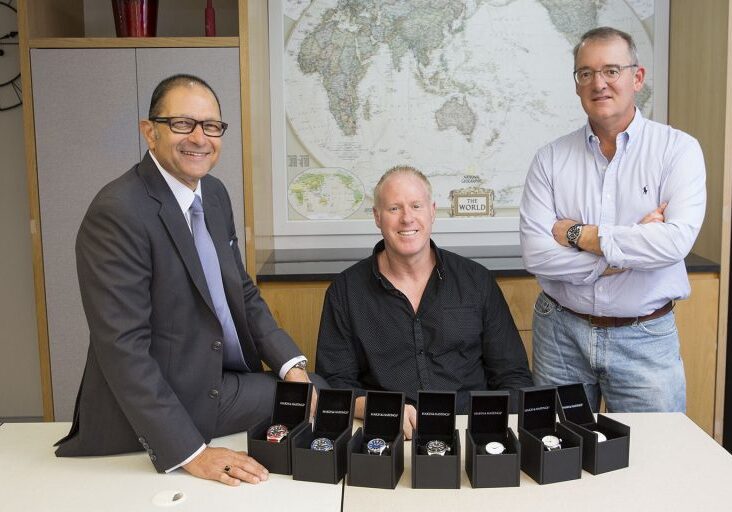

Auxilium Partners is a WA owned and operated insolvency, forensic accounting and mining advisory firm based in West Perth.

Our partners Bob Jacobs and Andrew Smith are Registered Liquidators with ASIC and Paul Cockburn is a Certified Fraud Examiner.

Access Free Updates

Business restructuring news and tips to survive financially difficult times.

More from the Blog

Check out the blog for news, information , and resources.